HomeGuy

2014-05-21 04:25:13 UTC

More good news about the US economy and the american ho moaner:

For those Millennials who do manage to accumulate a down payment

by the time they are in their early 30s there is precious little

starter home inventory available. The Greenspan mortgage debt

serfs from the previous generation are blocking the way.

Nearly 10 million U.S. households remain stuck in homes worth

less than their mortgage and a similar number have so little

equity they cant meet the expenses of selling a home

In addition to the homeowners who are underwater, roughly

10 million households have 20% or less equity in their homes,

which makes it difficult for them to sell their homes without

dipping into their savings. Most move-up homeowners typically

use their home equity to cover broker fees, closing costs and

a down payment for their next home. Without those funds, many

homeowners cant sell.

==========================

The Greenspan Housing Bubble Lives On: 20 Million Homeowners Cant

Trade-Up Because They Are Still Underwater

One of the most deplorable aspects of Greenspans monetary central

planning was the lame proposition that financial bubbles cant be

detected, and that the job of central banks is to wait until they crash

and then flood the market with liquidity to contain the damage.

In fact, after the giant housing bubble crashed and left millions of

Main Street victims holding the bag, Greenspan evacuated the Eccles

Building, and then spent nearly a whole chapter in his memoirs

explaining how this devastation wasnt his fault.

Instead, he blamed Chinese peasant girls who came by the millions to the

east China export factories where they lived a dozen at a time cramped

in tiny dormitory rooms working 14 hour days. According to the Maestro,

they saved too much, thereby enabling Americans to overdo it on the

mortgage borrowing front. Yes, in so many words he said exactly that!

Lets see. The Maestro was allegedly a data hound. Did he not notice that

housing prices in the US rose for 111 straight months from late 1994 to

2006, and during that period increased by nearly 200% on average across

US neighborhoods. How in the world could this giant aberration have

escaped the notice of the money printers around Greenspan in the Eccles

Building?

How in the world could any adult thinker blame this on factory girls in

Chinathat is, a policy regime that caused excessive savings. In fact,

it is plainly evident that the Peoples Printing Press of China

attempted to protect is exchange rate from appreciating against the

flood of dollars emitted from the Eccles Building. It did this in

mercantilist fashion by pegging the RMB exchange rate and thereby

accumulating a massive hoard of US treasury notes and Fannie/Freddie

paper.

In short, China didnt save America into a housing crisis; the

Greenspan Fed printed America into a cheap debt binge that ended up

impairing the residential housing market for years to come.

So the problem with central bank inflation of financial bubbles is that

when they burst the damage is extensive, capricious and long-lasting. On

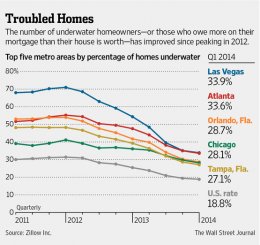

the latter front, new data from Zillow Inc. provide a dramatic case in

point.

Here we are 96 months after the housing peak, yet there are still 20

million households which are either underwater on their mortgages or do

not have enough embedded equity to cover the transaction costs and down

payment needed to move. Since there are only 50 million households with

mortgages, that means that as a practical matter 40% of mortgage

borrowers are precluded from trading-up.

It is no great mystery that historically trade-up borrowers have been

the motor force that drove the US housing market. Selling their existing

home for a better castle, trade-up buyers vacated the bottom-end of the

market so that first time buyers could find a foothold.

Now thanks to Washingtons eternal conviction that debt it the magic

elixir of economic growth, first time buyers are few and far between

because they are buried in student debt-about $1.1 trillion to be

exact. Each graduating class has more students with loans to carry

forward, and in higher and more onerous amounts. Fully 70% of the class

of 2014 has student loans, and they average of about $30,000 each. Both

figures are triple what they were just a decade ago.

In any event, for those Millennials who do manage to accumulate a down

payment by the time they are in their early 30s there is precious little

starter home inventory available. The Greenspan mortgage debt serfs

from the previous generation are blocking the way.

Monetary central banking is an economy wrecker. Here is just one more

smoking gun of proof.

Loading Image...

Nearly 10 million U.S. households remain stuck in homes worth less than

their mortgage and a similar number have so little equity they cant

meet the expenses of selling a home, trends that help explain recent

sluggishness in the housing recovery.

At the end of the first quarter, some 18.8% of U.S. homeowners with a

mortgage9.7 million householdswere underwater on their mortgage,

according to a report scheduled for release Tuesday by real-estate

information site Zillow Inc.

While that is an improvement from 19.4% at the end of last year and a

peak of 31.4% 2012, those figures understate the problem.

In addition to the homeowners who are underwater, roughly 10 million

households have 20% or less equity in their homes, which makes it

difficult for them to sell their homes without dipping into their

savings. Most move-up homeowners typically use their home equity to

cover broker fees, closing costs and a down payment for their next home.

Without those funds, many homeowners cant sell.

Its a sobering appreciation that negative equity is going to be with

us for a while to come, said Stan Humphries, Zillows chief economist.

Negative equity is central to understanding a lot of the distortions in

the marketplace right now.

Those distortions include the inventory of homes for sale, which, while

rising, is low by historical standards. It also helps explain why

first-time home buyers are having such a hard time cracking the market.

Real estate is in some ways like a ladder, Mr. Humphries notes, so when

underwater homeowners dont trade up it makes it harder for newcomers to

get in.

Click here for the rest of the article:

http://online.wsj.com/news/articles/SB10001424052702304422704579572261754798636?mod=WSJ_hp_RightTopStories&mg=reno64-wsjlick

http://www.zerohedge.com/news/2014-05-20/greenspan-housing-bubble-lives-20-million-homeowners-can%E2%80%99t-trade-because-they-are-st

For those Millennials who do manage to accumulate a down payment

by the time they are in their early 30s there is precious little

starter home inventory available. The Greenspan mortgage debt

serfs from the previous generation are blocking the way.

Nearly 10 million U.S. households remain stuck in homes worth

less than their mortgage and a similar number have so little

equity they cant meet the expenses of selling a home

In addition to the homeowners who are underwater, roughly

10 million households have 20% or less equity in their homes,

which makes it difficult for them to sell their homes without

dipping into their savings. Most move-up homeowners typically

use their home equity to cover broker fees, closing costs and

a down payment for their next home. Without those funds, many

homeowners cant sell.

==========================

The Greenspan Housing Bubble Lives On: 20 Million Homeowners Cant

Trade-Up Because They Are Still Underwater

One of the most deplorable aspects of Greenspans monetary central

planning was the lame proposition that financial bubbles cant be

detected, and that the job of central banks is to wait until they crash

and then flood the market with liquidity to contain the damage.

In fact, after the giant housing bubble crashed and left millions of

Main Street victims holding the bag, Greenspan evacuated the Eccles

Building, and then spent nearly a whole chapter in his memoirs

explaining how this devastation wasnt his fault.

Instead, he blamed Chinese peasant girls who came by the millions to the

east China export factories where they lived a dozen at a time cramped

in tiny dormitory rooms working 14 hour days. According to the Maestro,

they saved too much, thereby enabling Americans to overdo it on the

mortgage borrowing front. Yes, in so many words he said exactly that!

Lets see. The Maestro was allegedly a data hound. Did he not notice that

housing prices in the US rose for 111 straight months from late 1994 to

2006, and during that period increased by nearly 200% on average across

US neighborhoods. How in the world could this giant aberration have

escaped the notice of the money printers around Greenspan in the Eccles

Building?

How in the world could any adult thinker blame this on factory girls in

Chinathat is, a policy regime that caused excessive savings. In fact,

it is plainly evident that the Peoples Printing Press of China

attempted to protect is exchange rate from appreciating against the

flood of dollars emitted from the Eccles Building. It did this in

mercantilist fashion by pegging the RMB exchange rate and thereby

accumulating a massive hoard of US treasury notes and Fannie/Freddie

paper.

In short, China didnt save America into a housing crisis; the

Greenspan Fed printed America into a cheap debt binge that ended up

impairing the residential housing market for years to come.

So the problem with central bank inflation of financial bubbles is that

when they burst the damage is extensive, capricious and long-lasting. On

the latter front, new data from Zillow Inc. provide a dramatic case in

point.

Here we are 96 months after the housing peak, yet there are still 20

million households which are either underwater on their mortgages or do

not have enough embedded equity to cover the transaction costs and down

payment needed to move. Since there are only 50 million households with

mortgages, that means that as a practical matter 40% of mortgage

borrowers are precluded from trading-up.

It is no great mystery that historically trade-up borrowers have been

the motor force that drove the US housing market. Selling their existing

home for a better castle, trade-up buyers vacated the bottom-end of the

market so that first time buyers could find a foothold.

Now thanks to Washingtons eternal conviction that debt it the magic

elixir of economic growth, first time buyers are few and far between

because they are buried in student debt-about $1.1 trillion to be

exact. Each graduating class has more students with loans to carry

forward, and in higher and more onerous amounts. Fully 70% of the class

of 2014 has student loans, and they average of about $30,000 each. Both

figures are triple what they were just a decade ago.

In any event, for those Millennials who do manage to accumulate a down

payment by the time they are in their early 30s there is precious little

starter home inventory available. The Greenspan mortgage debt serfs

from the previous generation are blocking the way.

Monetary central banking is an economy wrecker. Here is just one more

smoking gun of proof.

Loading Image...

Nearly 10 million U.S. households remain stuck in homes worth less than

their mortgage and a similar number have so little equity they cant

meet the expenses of selling a home, trends that help explain recent

sluggishness in the housing recovery.

At the end of the first quarter, some 18.8% of U.S. homeowners with a

mortgage9.7 million householdswere underwater on their mortgage,

according to a report scheduled for release Tuesday by real-estate

information site Zillow Inc.

While that is an improvement from 19.4% at the end of last year and a

peak of 31.4% 2012, those figures understate the problem.

In addition to the homeowners who are underwater, roughly 10 million

households have 20% or less equity in their homes, which makes it

difficult for them to sell their homes without dipping into their

savings. Most move-up homeowners typically use their home equity to

cover broker fees, closing costs and a down payment for their next home.

Without those funds, many homeowners cant sell.

Its a sobering appreciation that negative equity is going to be with

us for a while to come, said Stan Humphries, Zillows chief economist.

Negative equity is central to understanding a lot of the distortions in

the marketplace right now.

Those distortions include the inventory of homes for sale, which, while

rising, is low by historical standards. It also helps explain why

first-time home buyers are having such a hard time cracking the market.

Real estate is in some ways like a ladder, Mr. Humphries notes, so when

underwater homeowners dont trade up it makes it harder for newcomers to

get in.

Click here for the rest of the article:

http://online.wsj.com/news/articles/SB10001424052702304422704579572261754798636?mod=WSJ_hp_RightTopStories&mg=reno64-wsjlick

http://www.zerohedge.com/news/2014-05-20/greenspan-housing-bubble-lives-20-million-homeowners-can%E2%80%99t-trade-because-they-are-st